Obligatory CYA - don’t take any of this as financial advice please!

For those of you keeping track, the market right now is a little… turbulent. Recently, I used AI to analyze my investment allocations and thought I’d share some ways that AI can support you with your financial and investment strategies.

The need for better financial understanding

Have you ever thought that we could do basic investing and financial education a little better? Why not teach it in high school along with math and physics? Investing is such a crucial life skill, and it is not straightforward. There are so many strategies, options, and schools of thought on what to do and when to do it. Stocks, bonds, managed funds. Are SPACs legit? Should I invest in crypto?

I have an MBA, and I try and keep up with financial news, and I’m regularly questioning myself on what to do. I’m competing with everyone else in the world including the big Investment Banks and I’m trying to come out on top? Oh, and don’t forget about tax implications before you do anything. It’s a lot to consider.

So how are we supposed to protect and grow our little nest eggs?

AI vs The Market

Traditionally, the advice would be to rely on a personal financial advisor – a solid approach and probably the right one if you can manage it. There’s friction involved in that though – finding a trusted advisor, scheduling and spending time with them, and of course paying fees (fair enough). Sometimes, though, you just want to understand this complex financial world a little better. Do some planning privately. Explore your next move and identify some investments that you hope will grow over time.

Google is an obvious starting point here, unearthing the vast amounts of content and information available online. That’s fantastic – try that too. It’s a lot to sift through though, and much of it is geared towards trying to sell you something.

This is where AI shines. Similar to other applications that we’ve explored previously, AI makes sense of the complex, simplifying it and tailoring advice to your unique situation based on your personal financial goals.

You can use AI as a financial coach including (but not limited to):

Budgeting

Financial goal setting

Tax strategies

Investment research

Retirement planning.

Previously, this tailored approach was difficult to do without working with someone. Now, you’ve got an always-on financial coach at the ready (even during a walk outside). Let’s dive in and explore what AI can do for you here.

Getting Started with AI Financial Coaching

Basic Budgeting Assistance

A penny saved is a penny earned and all that. The easiest way to get a handle on personal finances and ultimately start increasing your net worth is to start with some basic budgeting. I personally haven’t used AI for this as much, but the general idea would be to start a chat, provide it with your information, get advice and analysis from your AI coach, and come back to that same chat with monthly updates and requests over time.

📝 Example Prompt: I make $4,500 per month and spend roughly $1,200 on rent, $400 on car payments, $500 on groceries, and $300 on utilities. Can you analyze my budget and suggest improvements?

The output I got was solid. Take what you like, leave what you don’t, and check back in that same chat with updates and new requests. Respond to its advice, give it your progress, provide new goals, show progress, and repeat.

Understanding Financial Concepts

As mentioned above, finance is complex! AI can break down complex financial topics in simple terms. You can ask it to explain concepts such as:

Compound interest and the "Rule of 72"

Asset allocation and diversification principles

Risk tolerance assessment and how it shapes investment choices

Market capitalization (large-cap, mid-cap, small-cap)

Tax-advantaged accounts like 401(k), IRA, Roth IRA, HSA

Index funds vs. actively managed funds

Bond yields and the relationship with interest rates

Inflation and its effect on purchasing power

And if you don’t know where to start, just ask it to list out 20 financial topics to kick off your conversation together. You could spend hours just doing this.

Starting your Investment Journey

If you’re newer to financial planning, AI can help you get started. Looking for a better way to stash some cash? AI can give you some great simple options and planning for simple allocations.

📝 Example Prompt: I'm 32 years old and have never invested before. I have $5,000 saved that I'd like to invest. Can you explain my options in simple terms?

Some solid, straightforward investment advice. This was just the conclusion of its answer. From here you could ask it clarification questions, like “list out top ETFs to consider” (more on that below) or “what are my high-yield savings account options?”

Tailored investment and retirement coaching

For those seeking a more involved financial strategy, AI can act as a collaborator and coach. This is what I’m personally interested in - I wanted a coach to give me feedback on my strategy and to update my investments moving forward.

Below is what I used to prompt GPT to be my personal investing coach. It’s probably overkill… ok almost certainly… but I like to take some time upfront on my first prompt when I plan to use a chat over an extended timeframe. It’s worth a little more time framing things upfront, which sets the tone for the rest of the chat (general prompting suggestions here).

📝 Example Prompt: Act as my personal financial advisor and investment collaborator. Your goal is to help me manage my investment portfolio in a straightforward, simple, and effective way so I can retire comfortably at age [age goal] with at least $[net worth goal] in net worth. I am currently [age] years old with an estimated net worth of [$$$], including equities, a 401k account, real estate, and other investments. Your role is to provide tailored investment strategies, tax-efficient advice, estate planning guidance, and regular check-ins to help me stay on track. As a collaborator, you should ask me relevant questions to better understand my goals, risk appetite, family needs, and preferences. I want you to explain your recommendations clearly, offer alternative strategies when appropriate, and help me understand both the risks and potential rewards of each approach. Focus on long-term wealth building, diversification, and tax optimization, while keeping the strategies simple and effective. Help me craft a flexible, dynamic plan that adapts as my circumstances evolve.

The AI will then ask clarifying questions like your investment portfolio detail, risk tolerance, and what your overall financial and retirement goals are. You can even upload screenshots and financial documents for AI to interpret. It will then draft a personalized financial plan, offering structured investment strategies and considerations. Some tools can even generate spreadsheets for tracking over time (as you can see below, when I was asking it to model management of some Microsoft stock that I have).

The magic is in the collaboration you have with your AI coach. For instance, it will probably ask you what your financial retirement goals are. If you don’t have a “number” or end financial goal in place yet, that would be a great thing to ask your financial coach about and explore together.

This is your coach that generates a personal plan just for you. You can use it as a one-off check-in when you’re rethinking your financial allocations or can utilize your plan as an ongoing document that you refer back to periodically. It will give you feedback on progress based on your input as often as you’d like.

Note: A note on privacy since we are talking about sensitive financial data here. Just like most service providers (like search engines and web browsers) you are choosing to share personal data with a 3rd party when you do this. If you’re concerned about privacy, check out your AI service’s rules around it. Typically (though not always) AI services will train on free user’s data but give paying users the ability to opt-out and remain private (for instance OpenAI’s policies).

AI Research-ing Investments

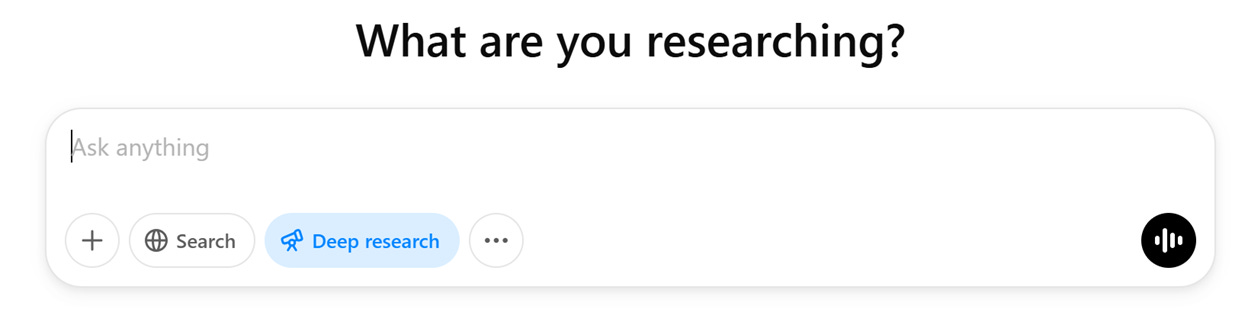

We learned last week how to use AI Research capabilities, and we can put these to use here as well. Think of AI Research as a Google search on steroids, searching publicly available information for you and summarizing it so that you can learn it easily. In this application, AI’s research capabilities could be leveraged to explore different financial instruments that you’re consider investment in, such as individual stocks, mutual funds, and ETFs.

The process would look something like this:

Open a new chat that you’ll use to craft your prompt (or feel free to use my prompt helper if you use GPT). Ask it to craft an AI Research prompt that you can use to explore different financial instruments on the market (individual stocks, mutual funds, ETFs, etc.) – whatever you’re interested in. When you’re happy with the output, copy the prompt.

Open another new chat, select a AI Research capability, and paste the prompt in.

Answer any preliminary questions that it asks.

Watch as it starts and works its research magic.

Note: The advice I got was generally great, but I did notice some issues with some of the current prices that were listed out, which would have materially changed their appeal. A reminder to always double check important info!

In Conclusion

AI won’t replace a certified financial advisor for complex situations, but it’s a powerful everyday financial partner and coach. It can be the first step in financial planning, allowing you to make informed decisions before consulting a professional, or even act independently if you feel confident. Whether you’re just starting out or fine-tuning your wealth strategy, AI can help you make smarter, more confident financial decisions.

And again - obligatory CYA - don’t take any of this as financial advice please!

Always solid information Adam! Your AI articles are very helpful, especially when suggesting prompts in the topics you discuss.